Introduction

HSCL Overview

Hyderabad Securities Company Limited (HSCL) is a leading brokerage firm in Pakistan with a strong reputation in the stock market. Established in 1950, HSCL has a long history of providing brokerage services to a diverse client base. The company offers a wide range of services, including equity trading, commodities trading, research, and advisory services.

Factors Affecting HSCL Share Price

Several factors can influence the share price of HSCL. Understanding these factors can help investors make informed decisions when trading HSCL shares.

-

Market Trends: The overall stock market trends in Pakistan can have a significant impact on HSCL’s share price. Positive market trends often result in an increase in share prices, while negative trends can lead to a decline.

-

Company Performance: The financial performance of HSCL plays a crucial role in determining its share price. Strong earnings, revenue growth, and profitability can attract investors and drive up the share price.

-

Industry Dynamics: The brokerage industry’s overall performance and competitiveness can also affect HSCL’s share price. Changes in regulations, market conditions, and industry trends can impact the company’s stock price.

-

Macroeconomic Factors: Economic indicators, such as inflation rates, interest rates, and GDP growth, can influence investor sentiment and, in turn, HSCL’s share price.

-

Company News and Events: Announcements related to HSCL, such as new partnerships, acquisitions, or product launches, can impact the company’s stock price. Positive news can lead to a spike in share prices, while negative news can result in a decline.

-

Investor Sentiment: Public perceptions, market rumors, and investor sentiment can also play a role in determining HSCL’s share price. Positive sentiment can drive demand for the stock, leading to an increase in share prices.

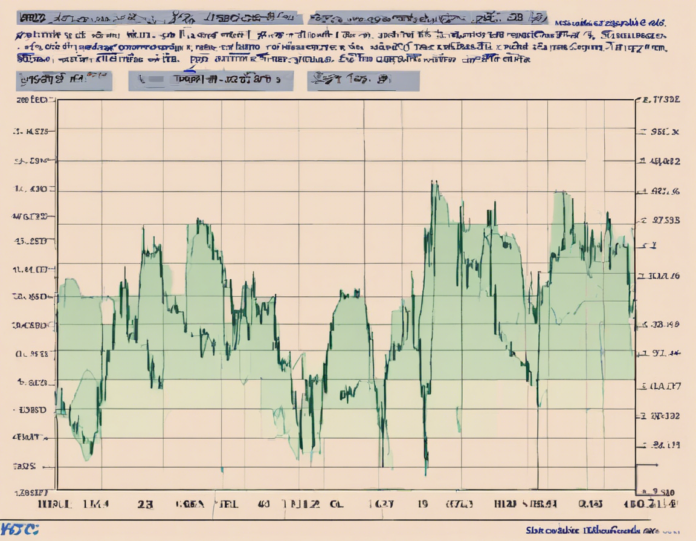

Technical Analysis of HSCL Share Price

Technical analysis is a method used by traders and investors to evaluate securities’ past price movements and forecast future price trends. When applying technical analysis to HSCL’s share price, investors may consider the following key metrics and indicators:

-

Moving Averages: Moving averages can help identify trends and potential reversal points in HSCL’s share price. Investors often use 50-day and 200-day moving averages to gauge the stock’s overall direction.

-

Relative Strength Index (RSI): The RSI is a momentum indicator that measures the speed and change of price movements. A high RSI value may indicate that a stock is overbought, while a low value could suggest it is oversold.

-

Volume Analysis: Analyzing trading volume can provide insights into investor interest and market sentiment towards HSCL’s shares. Unusual spikes in volume may signal a potential price movement.

-

Support and Resistance Levels: Identifying key support and resistance levels can help traders determine entry and exit points for HSCL’s stock. These levels indicate where the stock is likely to encounter buying or selling pressure.

-

Chart Patterns: Chart patterns, such as head and shoulders, flags, and triangles, can provide clues about future price movements in HSCL’s share price. Traders often look for these patterns to make informed trading decisions.

Fundamental Analysis of HSCL Share Price

Fundamental analysis involves evaluating a company’s financial health, business model, management team, and competitive position to determine its intrinsic value. When conducting fundamental analysis of HSCL’s share price, investors may consider the following factors:

-

Earnings Per Share (EPS): EPS is a key financial metric that indicates a company’s profitability. Rising EPS may signal a positive outlook for HSCL and could lead to an increase in share prices.

-

Price-to-Earnings (P/E) Ratio: The P/E ratio compares a company’s stock price to its earnings per share. A low P/E ratio may indicate that HSCL’s stock is undervalued, while a high ratio could suggest it is overvalued.

-

Dividend Yield: Dividend yield measures the percentage of income a company pays out to its shareholders in the form of dividends. A high dividend yield may attract income-focused investors and support HSCL’s share price.

-

Debt Levels: Evaluating HSCL’s debt levels can provide insights into the company’s financial stability and risk profile. High debt levels may pose challenges and impact the stock price negatively.

-

Growth Prospects: Assessing HSCL’s growth potential, market position, and competitive advantages can help investors determine the stock’s long-term prospects. Companies with strong growth prospects often command higher share prices.

-

Management Quality: The quality of HSCL’s management team, their track record, and strategic decisions can influence investor confidence and, ultimately, the company’s share price.

Investment Strategies for HSCL Share Price

Investors looking to trade HSCL shares can consider various investment strategies based on their risk tolerance, investment goals, and time horizon. Some common strategies include:

-

Day Trading: Day traders aim to profit from intraday price movements in HSCL shares by buying and selling within the same trading day. This strategy requires quick decision-making and a high tolerance for risk.

-

Swing Trading: Swing traders hold HSCL shares for a few days to weeks to capitalize on short-to-medium-term price fluctuations. This strategy relies on technical analysis and market trends to identify entry and exit points.

-

Value Investing: Value investors seek undervalued stocks like HSCL that have strong fundamentals and growth potential. This strategy involves buying shares at a discount to their intrinsic value and holding them for the long term.

-

Dividend Investing: Dividend investors focus on companies with a history of paying consistent dividends, such as HSCL. By reinvesting dividends or receiving regular income, investors can build wealth over time.

-

Growth Investing: Growth investors target companies with high growth potential, such as HSCL, that are expected to outperform the market. This strategy involves capitalizing on companies’ expansion and innovation to achieve substantial returns.

Risks and Challenges

Investing in HSCL shares comes with certain risks and challenges that investors should be aware of before making any investment decisions. Some common risks include:

-

Market Volatility: The stock market can be volatile, with prices fluctuating rapidly due to various factors. HSCL’s share price may experience significant volatility, leading to potential losses for investors.

-

Regulatory Changes: Changes in regulations governing the brokerage industry in Pakistan can impact HSCL’s operations and financial performance. Investors should stay informed about regulatory developments that may affect the company.

-

Competition: The brokerage industry is highly competitive, with rival firms vying for market share and clients. HSCL faces competition from other brokerage firms that could affect its market position and profitability.

-

Economic Conditions: Economic downturns, inflation, and other macroeconomic factors can influence investor sentiment and stock prices, including HSCL’s. Weak economic conditions may lead to a decline in share prices.

-

Liquidity Risk: HSCL shares may lack liquidity, making it difficult for investors to buy or sell large quantities without affecting the stock price. This illiquidity can result in price slippage and impact investment returns.

FAQs

-

What is the current market outlook for HSCL shares?

The current market outlook for HSCL shares is positive, with growing interest from investors and a favorable industry environment. -

How can I track HSCL’s share price performance?

Investors can track HSCL’s share price performance through online trading platforms, financial news websites, and the Pakistan Stock Exchange (PSX) website. -

Does HSCL pay dividends to its shareholders?

Yes, HSCL has a history of paying dividends to its shareholders based on the company’s financial performance and dividend policy. -

What are the key growth drivers for HSCL’s share price?

Key growth drivers for HSCL’s share price include strong financial performance, market expansion, technological advancements, and strategic partnerships. -

Is HSCL a high-risk investment?

Like any investment in the stock market, investing in HSCL shares carries inherent risks. Investors should conduct thorough research and consider their risk tolerance before investing.

Conclusion

Investing in HSCL shares can be a rewarding opportunity for investors looking to capitalize on Pakistan’s stock market growth and the brokerage industry’s potential. By understanding the factors influencing HSCL’s share price, conducting technical and fundamental analysis, and adopting suitable investment strategies, investors can make informed decisions to maximize returns and manage risks effectively. As with any investment, careful consideration, due diligence, and a long-term approach are essential for success in trading HSCL shares.